« February, March Residential, Vacant Land MLS Stats | Home | Common ground: Saving Three Sisters Springs »

Survey of Florida’s Emerging Market Conditions

By Alison Markham, Broker-Associate, GRI, Realtor® | April 2, 2008

Despite the growing concerns about recession, residential foreclosures, falling house prices and disruption of financial markets, our survey respondents maintain an unchanged, even slightly positive view of investment in Florida real estate at this time.Executive Summary & Conclusions

Despite the growing concerns about recession, residential foreclosures, falling house prices and disruption of financial markets, our survey respondents maintain an unchanged, even slightly positive view of investment in Florida real estate at this time.Executive Summary & Conclusions

A somberness has settled over residential real estate as the world has come to realize the depth of the “sub-prime meltdown” and the extremity of price inflation in some sectors of housing. Amplified through the financial markets, these clouds are finally extending their shadows into the non-residential sectors of Florida real estate as well. How dire is the forecast? Though there is increasing concern among analysts, the jury is still out on the prospects for a general recession, and for timely correction of the debilitating paralysis of many financial markets. In near defiance of these clouds, our respondents report that rental real estate in Florida still persists with a generally much more optimistic outlook. We summarize these views below.

podcast UF Real Estate Survey Podcast

The Bergstrom Center’s Dr. Wayne Archer discusses current results with Florida real estate analysts:

* Chuck Davis, Director, MetLife Real Estate Investments

* Hank Fishkind, Ph.D, Fishkind & Associates, Inc.

* Lew Goodkin, Goodkin Consulting

Gfx_SidebarHR subscribeSubscribe:

Podcast Home

Prominent Findings

* Despite the growing concerns about recession, residential foreclosures, falling house prices and disruption of financial markets, our survey respondents maintain an unchanged, even slightly positive view of investment in Florida real estate at this time. (This view appears consistent with rumored growing activity of “vulture” funds and other speculative ventures in Florida housing acquisitions.)

* The outlook of our respondents concerning new single family absorption continues to be for only slight declines from the present state. The outlook for condominiums, while more pessimistic, improved slightly.

* For market rent apartments occupancy is expected to hold steady while rental rates are expected to rise, but lag inflation.

* For Industrial property, office property and retail property, occupancy now is expected by some respondents to decline and rental rate increases will lag inflation.

* Despite the widespread concerns about financial markets, respondents expect capital to remain available for acquisition of existing rental properties.

* Respondents’ own business outlook continued a decline for the tenth straight quarter.

* The stability of cap rates for all except apartments, which increased by one percentage point, continues to suggest stable expectations for the value of Florida’s rental real estate. This is in sharp contrast to the value of many financial assets today.

The Survey

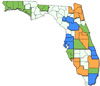

Our quarterly survey, conducted by the Bergstrom Center for Real Estate Studies, Warrington College of Business Administration, University of Florida is in its tenth fielding. The total number of participants, at 287, is the most extensive survey of Florida professional real estate analysts and investors conducted on an ongoing basis. It includes respondents representing thirteen urban regions of the state and up to fifteen property types.

General Investment Outlook

Our general index of real estate investment outlook, weighted 40 percent for single family and condo development, 40 percent for apartments and commercial rental property and 20 percent for developable land, shows surprising stability and resilience in contrast to the media picture of Florida real estate. Expectations continue to be neutral or mixed, and even trending slightly upward.

Single Family & Condominium Development

The outlook for absorption of new single family homes, for the fifth quarter running, indicates only a mild decline. While the outlook for absorption of new condominiums remains more pessimistic, it has improved slightly from the fourth quarter of 2007, and dramatically from the fourth quarter of 2006. Expected prices are more clearly pessimistic. Both for new single family and for condominiums, expectations have continued a five quarter decline, and a majority of respondents now expect price declines ahead. Despite this pessimism, the outlook for investment in single family and condo development has, for the second quarter, improved, suggesting that an increasing number of respondents are seeing relief for residential development ahead. Our respondents now see both single family development and condominiums, in Florida as a whole, as a mixed investment opportunity.

Apartments

After declining through 2007, the occupancy outlook for market rent apartments has turned upward very slightly, with a majority of respondents expecting positive change. While expected occupancy of apartments targeted for condo conversion is slightly negative, it also has reversed its late 2007 decline, showing a very small improvement. Expectations for rental rate growth in apartments, already below the rate of inflation, edged slightly more negative from the third and fourth quarters of 2007. The outlook for investment in market rent apartments remains positive and slightly improved from fourth quarter of 2007. The investment outlook for apartments targeted for condo conversion is more pessimistic, extending its downward drift into a third quarter.

Industrial

The outlook for occupancy in industrial property has declined for a fourth consecutive quarter. Some respondents, for the first time, expect industrial occupancy to decrease. Similarly, the outlook for industrial rental rates has declined, with expectations increasingly for rental rate growth to trail the rate of inflation. Despite these continued weakening expectations, the outlook for investment in industrial property remains mixed to positive, still very much as it has been for the last year.

Office

The outlook for office occupancy declined for still another quarter, the sixth straight. A slight majority of respondents now expect actual declining occupancy. The outlook for rental rates, after gradually drifting downward for the last year, has turned sharply downward. The balance of respondents now expects office rental rates to lag inflation, or even to decline. Despite this growing pessimism about near-term market conditions, the outlook for office investment has remained unchanged from the last quarter of 2007, with respondents giving a mixed to slightly positive assessment.

Retail

The outlook for retail occupancy has extended its decline to four straight quarters. The majority of respondents now expect actual occupancy declines for all types of retail. They are most pessimistic for large centers, and least so for neighborhood centers. The outlook for rental rates in most retail properties also has drifted downward over four quarters. Ironically, the exception is large centers, where the outlook has improved from last quarter, and where rental rate growth now is expected to match inflation. Despite declining expectations for retail occupancy and rental rate growth, respondents continue to view investment in retail as mixed. They are actually slightly more positive than in the last quarter of 2007.

Land Investment

The outlook for investment for all categories of land has continued a four quarter downward drift. Despite this the outlook remains mixed or neutral for land with entitlements for hospitality, warehouse and R and D, and for office. However, the outlook tends negative for land with entitlements for residential, for urban renewal or with no entitlements.

Capital Availability

Once again, in contrast to capital for single family mortgages, our respondents see no decline in availability of capital for acquisition of existing investment property. With capital for development there remains more pessimism, and some respondents continue for the fourth quarter running to believe the availability of capital for development has declined.

Cap Rates & Yields

With one exception, our respondents report cap rates that are little changed since first quarter of 2006. The exception is for apartments, where cap rates are reported to have increased roughly 100 basis points (one full percentage point) over the last two quarters. The steadiness of cap rates again has been in sharp contrast to the expectations of respondents, who have uniformly expected all cap rates to increase. Required yields have increased notably for apartments targeted for conversion. Otherwise they have remain unchanged for all property types.

Own Business Outlook

The own business outlook of our respondents, which has declined in all but one quarter since early 2006, continued a steady path downward. The contrast between this outlook and all the other results of the survey may be because many of our respondents derive a significant portion of their income from housing transactions.

Topics: Real Estate News | No Comments »

Comments

You must be logged in to post a comment.